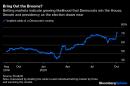

(Bloomberg Opinion) — I was on vacation over the past two weeks, a trip that began with news of Ruth Bader Ginsburg’s death and ended with President Donald Trump’s hospitalization after testing positive for Covid-19. It was strange, to be sure, though I watched from afar as markets took these momentous political events in stride: The S&P 500 Index moved less than 1% from Sept. 18 through Oct. 2, the benchmark 10-year Treasury yield rose by less than a basis point and investment-grade credit spreads barely budged. In general, politics is usually little more than a sideshow for financial markets and bond traders especially. However, with less than a month until U.S. elections, there are some signs that the typical relationship is changing. In particular, the nationwide horse race seems to have finally caught the attention of the world’s biggest debt market.The 30-year Treasury yield jumped by more than 10 basis points on Monday, the biggest increase in a month, to 1.59%, breaching its 200-day moving average for the first time since March 2019. The sharp increase pushed the U.S. yield curve from five to 30 years to 125 basis points, the steepest on a closing basis since December 2016.At that time, of course, the U.S. was turning over the presidency and majority control of both chambers of Congress to the Republican Party. In the two years that followed, thanks in no small part to fiscal stimulus in the form of sweeping tax cuts that largely benefited corporations and wealthy individuals, the economy grew at a fast enough pace that the Federal Reserve felt comfortable raising its benchmark interest rate seven times. That pushed 30-year yields to as high as 3.46% in November 2018, just days before Democrats won back a majority in the U.S. House.Based on the moves in Treasuries that started last week and only accelerated, it’s beginning to look as if traders are betting that history will repeat itself, only in the opposite direction. That is to say, Democrats will win the presidency, Senate and House and pass their own form of fiscal stimulus that will propel the U.S. economy past the coronavirus crisis and potentially even bring the Fed back into play.My Bloomberg Opinion colleague John Authers has been closely watching the election betting markets as of late, and I’ll leave it to his recent work to describe why Trump’s hospitalization and debate performance swung the odds. But all told, as of Oct. 3, using the implied odds from PredictIt, Democrats have an 88% chance of controlling the House and a 70% chance of taking the Senate after the election, both record highs. There’s a two-thirds chance that Joe Biden wins the presidency, according to PredictIt bettors, while FiveThirtyEight’s election forecasting model gives him an 81.2% chance.PredictIt has its own market for betting on a Democratic sweep, and those odds are about 58% now. But that seems low, given the state of the other races. A crude model that equally weights PredictIt’s individual probabilities(1) of the party controlling the House, Senate and presidency puts the chances of the Democrats running the table at closer to 73%, largely because of the recent sharp move in Senate odds.It’s not hard to extrapolate what such a scenario would mean for financial markets. First and foremost, it would most likely avoid the kind of chaos that has prompted all kinds of wagers and hedging in volatility markets. On the policy side, Democrats are seen as more amenable to passing another large fiscal relief package — something that Fed Chair Jerome Powell and his colleagues have been encouraging for months as leaders of the two parties remain unable to reach a compromise. That kind of spending could lift inflation above the central bank’s 2% target, which it has said under its new framework needs to happen “for some time” before it considers raising interest rates from near-zero. It turns out I’m not the only one connecting these dots. 九月 23, Goldman Sachs Group Inc. strategists Praveen Korapaty and Avisha Thakkar wrote that a clear victory by Biden, plus Democratic control of the House and Senate, is the scenario that would boost 10-year Treasury yields the most — potentially by 30 to 40 basis points over the following month. Short-end traders might start to bet the next Fed rate increase would come in 2023, rather than 2025, they said.Recalibrating Fed expectations from 2025 to 2023 might not seem like much, but it’s a big deal for the $20 trillion U.S. Treasury market, which has been mired in a narrow range for months. The ICE Bank of America MOVE Index, which measures bond-market volatility, fell to a record low on Sept. 29, the day of the first presidential debate. As Bloomberg News’s Katherine Greifeld and Emily Barrett noted recently, the gauge tracks one-month options from two-year notes to 30-year bonds, which means it reflects the Fed’s influence at the front end. If two-, three- or five-year yields became unstuck, that would suddenly make Treasuries across the curve much more interesting — not to mention push back against all the hand-wringing over bonds no longer serving as a reliable hedge for stock-market declines.To be clear, this scenario for Treasuries remains highly speculative. First, Americans have to actually cast their ballots in line with current polling averages. Then, elected officials need to pass effective legislation that will boost the economy and support the millions of people who remain jobless. And finally, that fiscal relief must make its way into inflation, which is notoriously complex, to encourage the Fed to tighten monetary policy. Those are a lot of “ifs.”Still, with several states already in the process of early voting, traders appear ready to position in earnest for not just what happens on Election Day, but for the implications over the coming years. For now, at least, the bond market is betting on a blue wave.(1) These odds are expressed in cents on the dollar, and don’t always sum to $1 (or 100%).This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.Brian Chappatta is a Bloomberg Opinion columnist covering debt markets. He previously covered bonds for Bloomberg News.

,